Amazing Tips About How To Appeal Your Property Taxes In Nj

If your property's assessment is more than $1 million, or if the.

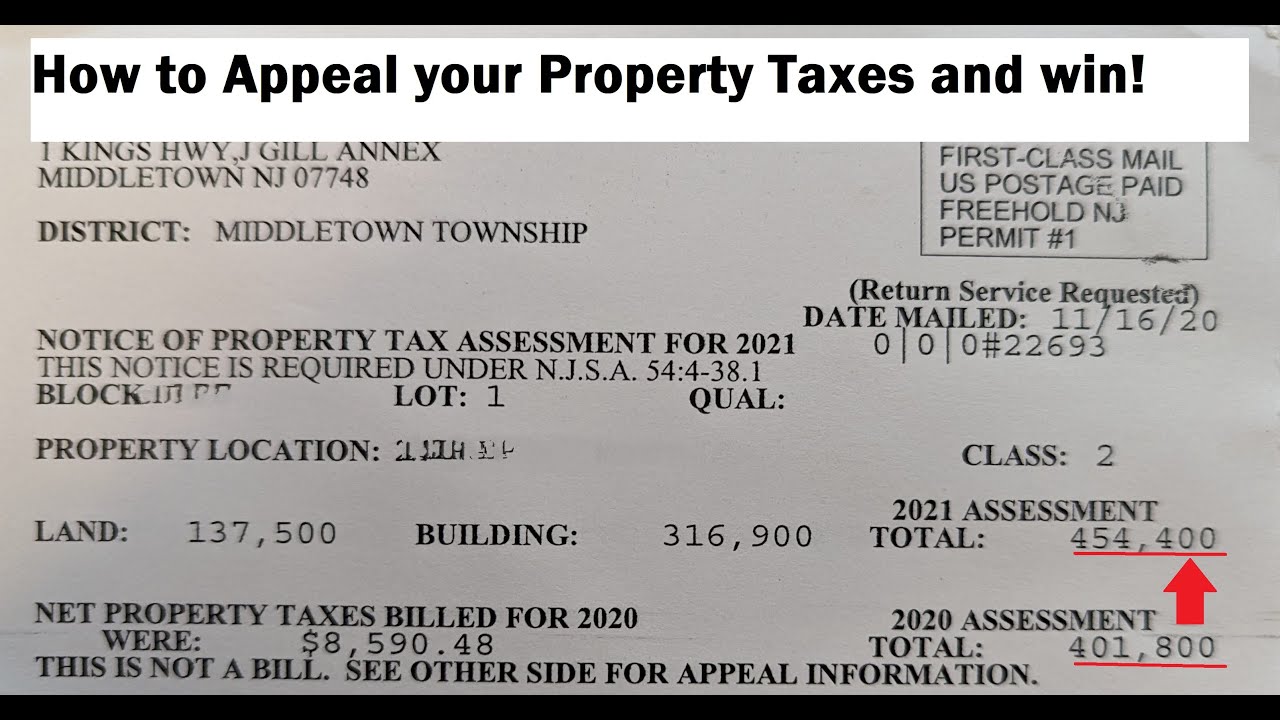

How to appeal your property taxes in nj. Filing a property tax appeal in new jersey is based on two standards: Check your property tax assessor’s website. However, at last check, only 6% of homeowners file an appeal.

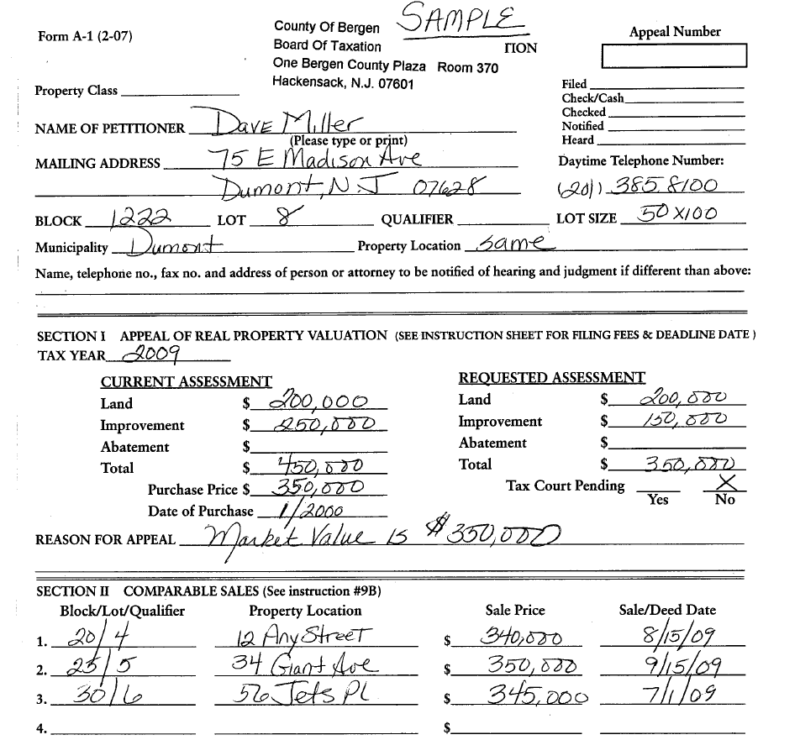

If you haven't yet, it would be helpful to hire a lawyer if you decide to. As soon as you receive your proposed property tax. If you submit your appeal, but do not agree with the final decision, you can take your appeal to the new jersey tax court.

Consider consulting a property tax appeal lawyer. This will be more advantageous because you can personally explain your case. There’s absolutely nothing fun about it!

Challenging your property tax assessment is not an easy process. Nj tax appeal covers the entire state of new jersey where markets may still be flat or trending down. True market value standard —all assessments must be 100% of true market value as of october 1 of the.

Cook county also gives you a free tool to locate and attach comparable. File your appeal with tax court within 45 days of the date of the county board of taxations judgment. Live in your primary residence in nj.

If your property's assessment is more than $1 million, or if the. Know how this game works. • ruled for determining a winnable case for an appeal • how (and where) to select the best.