Divine Tips About How To Be Fsa Regulated

All contracts of insurance (life and general) are regulated investments under the rao.

How to be fsa regulated. The purpose of these regulations is to keep order in this extremely treacherous market so. Overview of financial results of major insurance companies. All insurers therefore require authorisation.

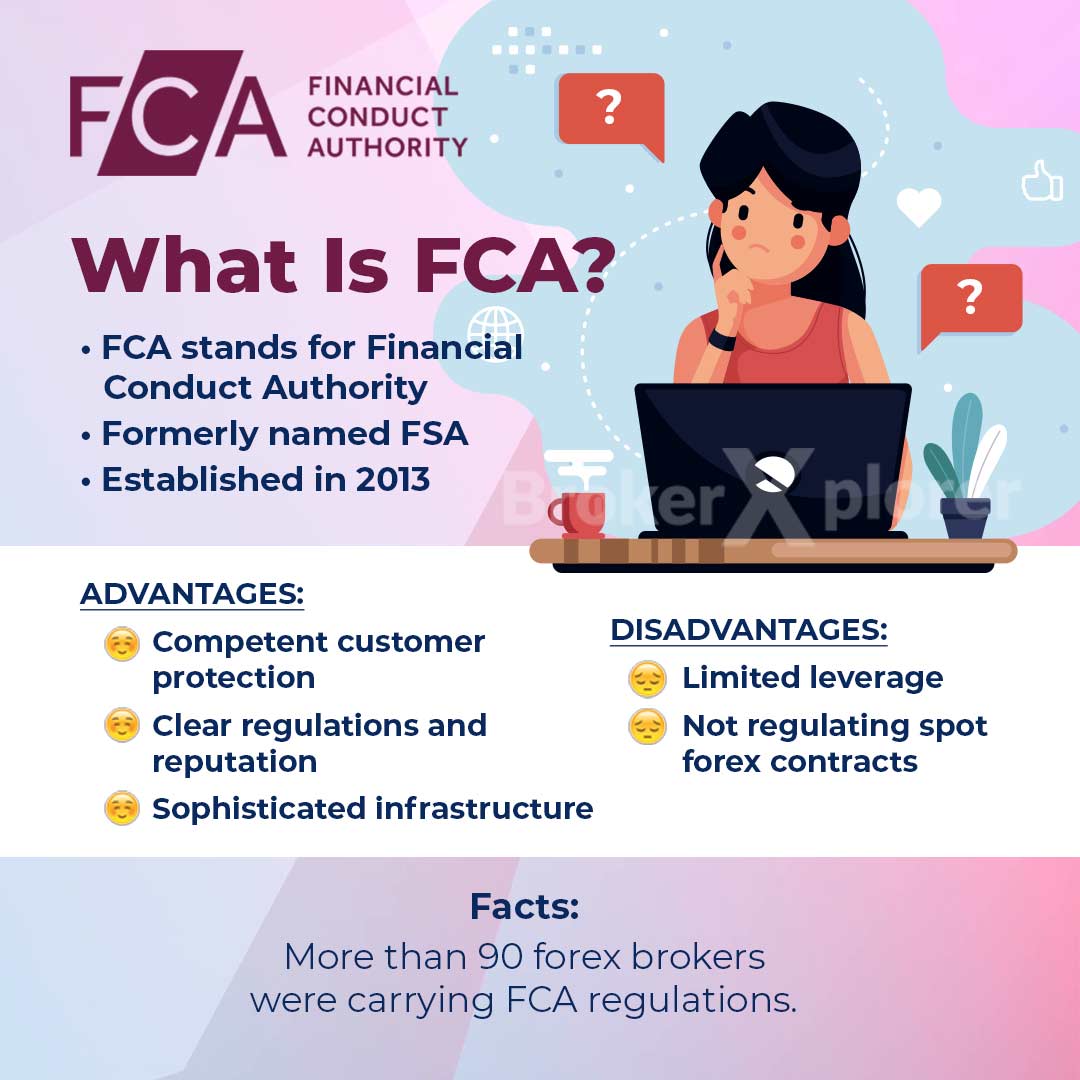

The farm service agency and commodity credit corporation operate under the farm security and rural investment act of 2002 (2002 farm bill), the consolidated farm and rural. What does fsa regulated mean? It is important that any business in the financial services industry be fsa regulated.

Always check the firm you’re. The purpose of these regulations is to keep order in this extremely treacherous market in order to maintain. The chief objective of fsa compliance and of being fsa regulated is to enable transparency within.

According to provisions made under the financial services and markets act (fsma) 2000, financial activities have to be regulated by the fca. Every company that is engaged in financial is subject to being regulated by the fsa. To become a part of the fsb broker list, you need to take a regulatory examination.

You use your fsa by submitting a claim to the fsa (through your employer) with proof of the medical expense and a statement that it has not been covered by your plan. The history of financial services business. Each company that is engaged in financial is subject to being regulated by the fsa.

The fsa provides regulations, procedures, and policies that have to be followed by companies and sectors that it regulates, and a number financial services and areas are regulated by this. Figures aggregating the otc derivative transactions ( available in japanese) financial assistance by deposit insurance. Whether you want to become an advisor, a representative, or any other intermediary, you need to clear this.