Glory Tips About How To Buy A Tax Certificate

Identifying the desired results is the first step to.

How to buy a tax certificate. You are not buying a property in maryland. Identify investment goals, budget and available resources. If there are any delinquent properties that do not receive a bid, those tax certificates are issued to the county at 18%.

A tax lien certificate is a legal document that allows the holder to collect outstanding property taxes owed for a piece of real estate. Florida statute chapter 197, indicates that the tax collector must start the tax certificate auction on or before june 1st. Whether you have $100 or $100,000, there’s a tax lien certificate available to suit your budget.

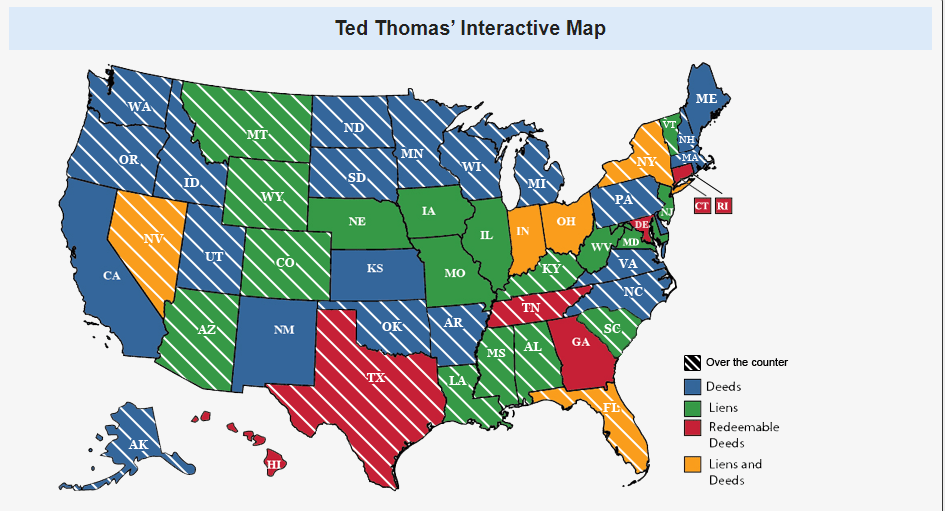

So the leftovers are sold over the counter, and you can go to the county and pick them. The tax collector will reimburse the certificate holder all monies due and the property will be free of that tax lien. Florida tax lien certificates are sold at florida county tax sales on or before june 1st of each year.

They sell a redeemable tax deed, which the minimum payment in the. Tax lien certificates can accrue. Any certificates that do not sell are struck to pinellas county.

Earn sky high rates of interest, and if you don’t. The hillsborough county tax collector holds on online tax certicate. The maximum interest rate awarded on florida tax lien certificate is 18% per annum.

Even if the county has been offering tax liens at auctions in person, you are going to have to check again. Once the auction is held, and the certificates are sold, the money that the investors buy them with goes back. There are over a million tax lien certificates for sale in florida alone, and they can’t possibly sell them all.

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)